Georgia Retirement Planning

The Walker Agency

Retirement is personal. You’ve worked hard to save and invest your money and now it’s time to optimize and protect your savings to provide for your retirement and your loved ones thereafter.

The Walker Agency is an independent financial services firm, specializing in helping individuals and families prepare for, plan, and live in retirement. Our approach focuses on tailored retirement planning strategies and insurance solutions to provide our clients with guaranteed lifetime income, asset protection, and achieve tax efficiencies in support of a holistic approach to their finances.

01

Start Smart

Get a Clear Understanding of Your Financial Life

First, we gain a thorough understanding of your current financial situation, goals, objectives, risk tolerance, and the key considerations that should be addressed in your retirement strategy.

Six Fundamental Financial Planning Considerations

Six key financial planning considerations can impact your financial goals now and in the future. The question is not if these will affect your finances, but to what degree. We evaluate your sentiment toward each consideration and quantify the potential effects on your assets over time. This allows us to build customized strategies to help you achieve your financial objectives for retirement.

Longevity

Outliving financial assets as the result of a longer life.

Inflation

Reduction in real purchasing power as the result of increasing cost of living.

Mortality

Loss of financial assets as the result of a partner’s or spouse’s death.

Liquidity

Limited access to assets to meet life’s unexpected financial needs.

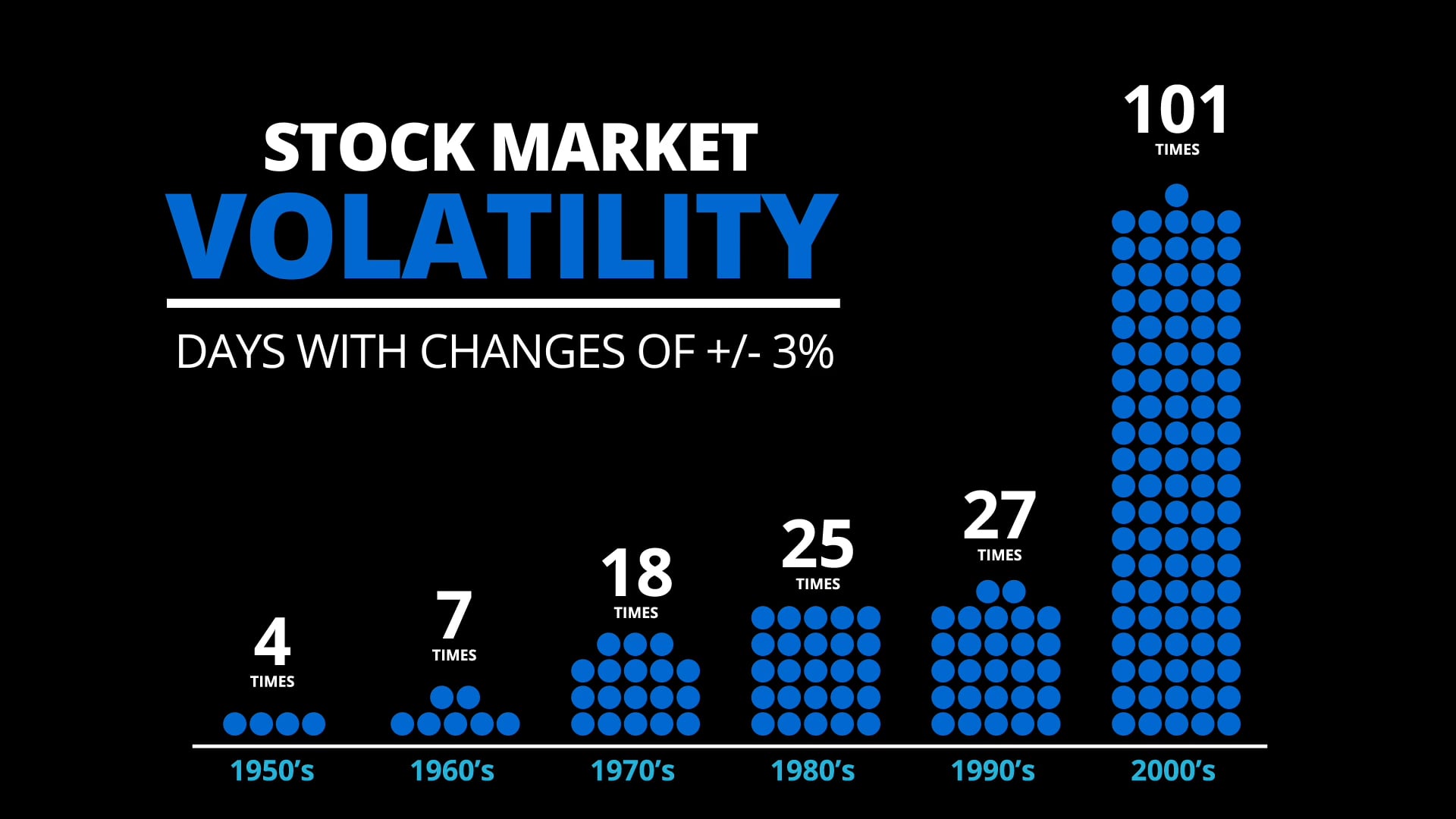

Market

Unexpected reduction in the value of financial assets at the time of withdrawal.

Taxes

Decreasing income and assets and/or the impairment of legacy assets from increasing taxes.

02

Apply Discipline

A Retirement Strategy Designed for You

Next, we design a retirement strategy that actively works to help optimize your wealth and protect your finances, keeping your goals and objectives at the forefront of our planning process.

03

Communicate Progress

Our Commitment to You

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive

outreach, and accessibility to our team throughout our working relationship.

Request Your

Receive Our

Have a Question?

Here For You

Meet The Advisor

Mychal Walker

President

Mychal graduated from Auburn University, where he received a degree in Mass Communications with a minor in Marketing, Philosophy and Theatre. Mychal’s experience in Radio, Television and Telecommunications has provided many venues for Mychal in the business world. After working several years with telecommunications giants such as AT&T, Bell South, and US Sprint in their marketing departments, he decided it was time to make his mark as an entrepreneur. Mychal started TriComm, Inc., his first company in 1986. TriComm provided communications systems to such clients as the Department of Defense, Centers for Disease Control and the Federal Aviation Administration to name a few.

In 2007, he began to migrate into the Insurance and Financial Services industry and provided consulting services to small businesses who focused on government contracting, utilizing insurance and financial products to assist his clients in growing and maintaining their businesses.

He also manages The Walker Agency, which addresses the needs of the senior market and healthcare related issues. Additionally, it also provides group benefits, property and casualty and other commercial insurance.

Mychal also owns CC And Associates, Inc., provides benefits to individuals and small employer groups. This also includes Medicare, Life and Annuities, as well as gap insurance to cover deductibles and coinsurance.

Mychal has been involved and served on numerous civic boards including representing Gwinnett County as a member of The Marta board of directors and the Gwinnett County Chamber of Commerce board of directors. In 1993, Mychal was selected by then US Senator Paul Coverdell to represent the Senator and the State of Georgia in Africa, at the 1st African / African American Economic Summit. Currently, Mychal serves on the Dean’s Advisory Board for the College of Liberal Arts at Auburn University.

Mychal is a Past President of The Georgia Association of Health Underwriters, in addition, he has served as Chair of the Health Underwriters’ Political Action Committee for the Southeast representing the National Association of Health Underwriters. Mychal has served two years as the Regional Vice President of the National Association of Health Underwriters. In August of 2021, Mychal was elected as the Chair of the Leadership Council for the Georgia Chapter of the National Federation of Independent Business. Mychal serves as a member of the Stakeholder Advisory Committee for the Georgia Insurance Commissioner, John King. In 2019, Mychal was appointed to serve on the Georgians First Commission Task Force, created by Georgia Governor Brian Kemp. In 2022, Governor Kemp appointed Mychal to the Georgia Department of Public Health.

In June of 2023, Mychal was elected as National Secretary for NABIP (National Association of Benefits and Insurance Professionals) and now serves as the National Treasurer and as a member of the Board of Trustees.

RR

Retirement Resources

Complimentary Educational Resources

Lastly and continually, we work to ensure transparency of your income plan by providing visibility, proactive outreach, and accessibility to our team throughout our working relationship.

Our Upcoming Events

Educational Events

Events in January 2026

- There are no events scheduled during these dates.

Client Events

Events in January 2026

- There are no events scheduled during these dates.

Our Blog

Financial Calculators

PLEASE NOTE: The information being provided is strictly as a courtesy. We make no representation as to the completeness or accuracy of information provided via these calculators. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, information and programs made available through the use of these calculators.